I saw the bearish divergence on the daily S&P 500 graph (screenshot attached).This says to me we are going to test the March bottom.Or may be I read the indicators in the wrong way?I will be happy to hear the opinion of other traders.Sorry for my English, it’s not my native language :)Thanks in advance– Vadim J

FSLR = Double Top + Island ReversalHeads up all.This is a great short setup with a technical footprint similar to the chart shared by Alex in his SpikeSpeak this last weekend where he showed a false breakout with a missing right shoulder for a short set up.FSLR has the potential – with the bad news release today – to gap down below it’s trough and slow EMA and form an island reversal for a quality short play. I plan to let it gap and retrace to the pivot, then short.Stephen M

FSLR = Double Top + Island ReversalHeads up all.This is a great short setup with a technical footprint similar to the chart shared by Alex in his SpikeSpeak this last weekend where he showed a false breakout with a missing right shoulder for a short set up.FSLR has the potential – with the bad news release today – to gap down below it’s trough and slow EMA and form an island reversal for a quality short play. I plan to let it gap and retrace to the pivot, then short.Stephen M

Good morning, Alex and Kerry,I have enjoyed seeing the equity curves published as I looked at them in a slightly different view than the quarterly competition. With the quarterly competition, one can become a little more reckless or conservative the last few weeks of the quarter, depending on where one is in the standings. The equity curves, though, show whether one or two huge gains or slow and steady gains have them at the top of the “rolling quarter” standings.Since one is not competing for prizes with this, I have used the curves to pay particular attention to those Spikers who have had consistent winners, limited losses, etc. The curve shape, unless I’m misreading something, tells me something about the targets, risks, that the trader has taken to achieve their performance. Does that fit my trading style? Should I follow their picks closely or look for someone with whom I’m more comfortable? I realize more bookkeeping to do the equity curves for you folks but if possible to keep it as a regular, even if not weekly, feature, I’d vote for that and use it.This is going to be difficult to appear as an “unbiased” comment on the equity curves since I’m lucky enough to be there but “scout’s honor”, I had begun to use them. Thanks, as always, and hope you all had time to enjoy the long holiday weekend.john t

To tell you the honest truth I have been waiting for this trade opportunity to set up for several weeks. When it finally gapped down after I posted about the set up…I was shaking with a combination of excitement and fear! Sort of like dating the hottest girl in school with your inner insecurities kicking in that gives you the feeling she is out of your league. You finally go out on that date and you stumble and bumble and maybe make a move too early before she is ready. Well I jumped in on the gap down day…normally I tell myself to sit on my hands…a man who falls off a cliff is not going to bounce and start running the same day- in most cases! Unless he is some kind of Navy Seal.I had written out a sort of “target” or “plan” at or near $1…I took (in 20/20 hindsight) a not great entry @ $1.11. I had my mental stop in place! Trust me! Like I have said before: “I am not a very good trader” and I need your help and feedback to try to improve. That is why I am posting up these trades to try to stimulate discussion which acts as “therapy” for a trader and helps put in place better habits and reactions. Anyway the area I need to most improvement is selling! Selling is the hardest decision for me for some reason. I got some therapy today because I sold! I don’t know why but the entry although mostly always fuzzy is more clear than the exit- maybe because of fear, greed, regret…I really need to stomp out those worthless emotions.Today I hit the sell button at $1.61. Booking a 45% gain and $5000 profit. My target was profit driven along with some function of chart technical’s. I always think it can go a little higher and most likely it will…but it is hitting a potential resistance zone at the edge of the gap. If it pulls back it could set up another classical bullish pattern and offer a reentry point. And then there is the feedback- Thank you all to those that provided comments on the set up idea. I hope we can share more dialog and ideas in the future together. I am more of a technical trader than a fundamentalist. I like to be on the contrarian side most of the time, but not all of the time. Who knows about this one? I just thought it looked very attractive technically! Sort of like the hot Thai Girl looking like she has all the right features, except you never know if you will get a “surprise” when the action starts.As I look down at my level 1 GM is ticking higher now 1.74…but I am happy. A target was reached and a profit was booked! Now let’s go find another good trade!Good Trading,Eric F

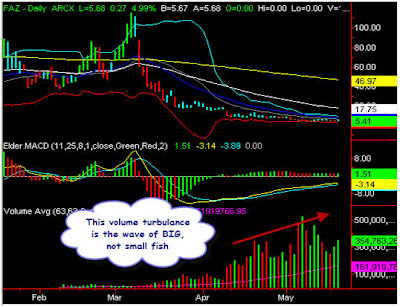

The late-comer bag holders know they’ve chased their late entries into this prolonged rally. These “greater fools” are uneasy, and while some have tightened stops, others have taken out big insurance to hedge their bets. Tomorrow’s lower prices may not be met with the buying that we’ve seen lately. Perhaps there’s no one left to fight the fire once smoke appears. Maybe they’d rather escape the burning building and collect the insurance money instead?

The late-comer bag holders know they’ve chased their late entries into this prolonged rally. These “greater fools” are uneasy, and while some have tightened stops, others have taken out big insurance to hedge their bets. Tomorrow’s lower prices may not be met with the buying that we’ve seen lately. Perhaps there’s no one left to fight the fire once smoke appears. Maybe they’d rather escape the burning building and collect the insurance money instead?

A couple of weeks ago, I noted that GLD was set up in a symmetrical triangle on the weekly charts. Frankly, I thought it would head down after a series of lower highs, but up it went. So, now what? Well, GLD did emerge, but it hasn’t been much of a rush–no real urgency in volume or momentum, yet the intermediate trend is up with a possible retest of the highs in the future. Though we broke out, the 2-day RSI tells us we’re short-term overbought. Some traders buy the breakout and in this case would have made money. Since I prefer a more conservative approach, I’m stalking GLD, looking for a retracement to value, or the rising 20-day EMA.

I have been very interested in the following the posts and the ensuing comments:

I just struggle with two concepts and I don’t know how to solve the conflict between them.The pyramiding strategy as discribed by Darvas and Livermore calls for continually adding to my position on a scale-up – but at this time the price is normally far above the moving average (what we call at value). On the other side, the ‘greater fool theory’ by Alex prohibits to buy above value or the moving average…..’I look forward to a fruitful discussion…

Double Top anyone?Where is the market headed and what is the potential degree of the move? Here are the characteristics that need to further materialize to confirm a double top:

Double Top anyone?Where is the market headed and what is the potential degree of the move? Here are the characteristics that need to further materialize to confirm a double top:

- The subsequent decline from the second peak should witness an expansion in volume with acceleration of the descent.

- Completion and confirmation occurs when prices break through support which is the lowest point between the peaks. This also shows an increase in volume.

- The potential price target is determined by the distance from the support break to the peak.

This would complete at approximately 402.