This is a major speculative idea. I have been waiting for several weeks watching and waiting and today it began to form. Are we seeing what I think we are seeing? A major bullish divergence? Let’s watch and see. Price points of interest maybe cracking 1.27?I hope it goes to a $1…Am I too early? It looks like it may have a little more room to run on the downside but I am not sure of how much it can run…Although one thing I know- It will either GO TO ZERO or snap back to life…Thanks,Eric F

This is a major speculative idea. I have been waiting for several weeks watching and waiting and today it began to form. Are we seeing what I think we are seeing? A major bullish divergence? Let’s watch and see. Price points of interest maybe cracking 1.27?I hope it goes to a $1…Am I too early? It looks like it may have a little more room to run on the downside but I am not sure of how much it can run…Although one thing I know- It will either GO TO ZERO or snap back to life…Thanks,Eric F

We should all be happy during this rally, right? Well, not so quick. In talking to trader friends and reading incoming emails, I sense a great deal of frustration. Today I would like to share with you two emails, one from a Spiker, another from a Member.Please post your comments, and later I will return with my own comments.Best wishes,AlexFROM A SPIKER:Dear Alex,The group beat indexes during the worst bear market, the group beat Indexes during the final phase of last bottoming on February , However the group has been beaten during last rally.How can you explain this phenomenon?To be honest, I have a negative return on my personal trading account since March 9, 2009.What happened to us?Have we grown into old and stubborn bears?Have we got a mental problem , imagining that we are smarter than the crowd and while we try to proof it for ourselves, the crowd earns money?For example, winners of last week were among bearish spikers and their results were modest, compared to Members who were bullish.Many of us have manically shorted Mr. Market from week to week, but it has been climbing and climbing.Based on technical and sentiment indicators , market is overbought and there are no ideas for professional traders to buy this market.Jason from sentimentrader.com has been neutral since beginning of April.Of course he didn’t participate in the last two weeks of peakining, however he saved his capital.May we need some rest?I think, some of us need a psychological advice.Best regards*******************FROM A MEMBER:Hello Alex,All the STOCKs that I have been followING for months have increased by 50% and more, some of them doubled or tripled.At the beginning of March, I was about to jump into the market and buy with both hands. At that time many signals told me a reversal could appear soon. I didn’t do it because that was not the way I learned: chasing the lows, red impulse, massive amounts of money into a few stocks, etc.Since then, I have been watching the market going higher and higher. All my friends, amateurs, are buying and making money. Even my mother is making money and everyone is wondering what’s going on with me, the most educated one on the topic. The greater fool theory works perfectly as Stephen M suggested it a few weeks ago. They buy far from the averages and their values keep going higher.I feel very stupid. In fact, I have never felt so dumB. I have the feeling that all the work I perform religiously on a daily basis is useless. In addition to technical analysis and psychology, you can’t imagine how much I read about the financial system, the economy, the complex relations between gold, Oil, USD and raw materials as well as Forex in order to understand the environment I had to face up, aiming at building a consistent system for monitoring the markets and trading in a professional way.Reading in your books that the market is manic-depressive is one thing. Living it is another story.I made some money with the energy sector capturing one third of the movement. However, you know how the beginner’s mind works: I can’t help calculating how much I could have earned if … and if … I’m trapped in mental loops of fictive profits with all the values I followed.You are a busy guy and you don’t have to answer me. I just want my shout to be heard by someone who understands because around me, it is the garden party. Regrets, sadness, bitterness, frustration, I feel very lonely. I can’t imagine the day I will be able to make a living with the markets. I’m ashamed of my poor performance. It is hard to stand back and to see this situation with a pinch of salt.Have a nice week-end.***************Thank you for your sincere emails.To all – please comment, and I will return with my own comments laterall the best,Alex

Just wanted to revisit the BRCD trade idea I suggested back on 4/15-16 here on this blog: http://spiketradeblog.blogspot.com/2009/04/brcd-bull-or-bear-y-eric-f.html

Just wanted to revisit the BRCD trade idea I suggested back on 4/15-16 here on this blog: http://spiketradeblog.blogspot.com/2009/04/brcd-bull-or-bear-y-eric-f.htmlNow the exit is so much more difficult than the entry in my opinion! Today I was 30 cents from Target #2 and it was dark cloud cover on large volume. It looks like it is going sideways here at $6 and its stretched from the EMA’s.

Since we had so much fun discussing GLD, I thought I throw out another one–DBA. However, since the price movement is pretty straightforward I doubt if we arouse the same level of opinion. DBA is the agricultural ETF, mostly softs. As you can see on the weekly, it crashed with everything else and has been trading sideways since Oct. 08. The result has been this enormous base, which means that the upside potential is equally enormous. The trick of course is the entry, and for that we need to look at the daily. The daily has a declining 200 DSMA, and a squeeze breakout showing. From past experience, the first time price hits a declining 200 DSMA it sells off. So, I’m waiting for price to come back to the rising 20 EMA, before thinking about buying. The other way to do it, would be to wait until price trades through the 200, and buy on the first pullback, or retest. Still, you could wait until the stock market corrects and the weekly 5-week RSI drifts back. The idea is not to chase an OB ETF, just be patient and wait for a reasonable entry. In any case, we can probably assume that the price of food isn’t going down much in the next few months.

Since we had so much fun discussing GLD, I thought I throw out another one–DBA. However, since the price movement is pretty straightforward I doubt if we arouse the same level of opinion. DBA is the agricultural ETF, mostly softs. As you can see on the weekly, it crashed with everything else and has been trading sideways since Oct. 08. The result has been this enormous base, which means that the upside potential is equally enormous. The trick of course is the entry, and for that we need to look at the daily. The daily has a declining 200 DSMA, and a squeeze breakout showing. From past experience, the first time price hits a declining 200 DSMA it sells off. So, I’m waiting for price to come back to the rising 20 EMA, before thinking about buying. The other way to do it, would be to wait until price trades through the 200, and buy on the first pullback, or retest. Still, you could wait until the stock market corrects and the weekly 5-week RSI drifts back. The idea is not to chase an OB ETF, just be patient and wait for a reasonable entry. In any case, we can probably assume that the price of food isn’t going down much in the next few months.

Jock G is a SpikeTrade guest. He is a Camp graduate and an extremely serious researcher and trader – AlexAnother perspective on gold: First, there’s no doubt that GLD and GDX are looking technically weak right now. Here’s a chart noting 4 false breakouts of GDX at resistance of 38: Since start of ’08, GLD has 3 times failed to close and hold above 97:

Since start of ’08, GLD has 3 times failed to close and hold above 97:

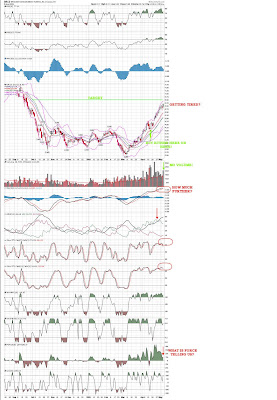

Longer-term charts are open to opposing interpretations:Grant looks at the monthly chart, sees a 1-2-3 top, and expects further weakness, Eric Fremd also looks at the monthly chart, but sees an inverted H&S, and potential for a long-term rally.This is no contradiction really, since no one can know the direction of the future “squiggles” of a chart. We can only assess future probabilities based on how we interpret today’s chart. And, events could change the picture tomorrow: oil blockade, assassination in Pakistan, Chinese pullback from buying US treasuries, inability of C and BAC to raise capital.Short-term, a continued pullback looks likely. There’d be no chance of a major “spike” till GLD broke out and held (on volume) over 100, and GDX did so over 38. Should that happen, however, it’s probably off to the races. I feel certain this global financial crisis is going to go on for some time yet. Plenty of time for GDX and GLD to touch the bottom of their trading ranges, and then “spike” way above the top of their channels.A look at the much longer term suggests why this could be the case. To me it’s compelling that in the major financial crises of the 30’s and 70’s, “super-spikes” DID occur. Here’s a look at a longer-term (and quite cluttered) chart:

Longer-term charts are open to opposing interpretations:Grant looks at the monthly chart, sees a 1-2-3 top, and expects further weakness, Eric Fremd also looks at the monthly chart, but sees an inverted H&S, and potential for a long-term rally.This is no contradiction really, since no one can know the direction of the future “squiggles” of a chart. We can only assess future probabilities based on how we interpret today’s chart. And, events could change the picture tomorrow: oil blockade, assassination in Pakistan, Chinese pullback from buying US treasuries, inability of C and BAC to raise capital.Short-term, a continued pullback looks likely. There’d be no chance of a major “spike” till GLD broke out and held (on volume) over 100, and GDX did so over 38. Should that happen, however, it’s probably off to the races. I feel certain this global financial crisis is going to go on for some time yet. Plenty of time for GDX and GLD to touch the bottom of their trading ranges, and then “spike” way above the top of their channels.A look at the much longer term suggests why this could be the case. To me it’s compelling that in the major financial crises of the 30’s and 70’s, “super-spikes” DID occur. Here’s a look at a longer-term (and quite cluttered) chart:

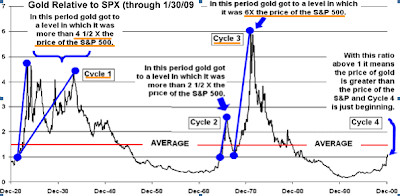

The headline is that in Cycle 1 (ending in 1938) and cycle 3 (ending in 1979) gold rose to levels of 4.5 and 6 times the S&P (respectively). The first “super-spike” of the 30’s was a response to deflation – the great depression. The second “super-spike” in the 70’s a response to major inflation (including the OPEC oil embargoes). The common theme was a massive loss of faith in the banks and their paper money.I don’t need to remind anyone that today’s psychology is similar. Gold’s latest “mini-spike” to 1000 was at the collapse of Bear Stearns. In fact, the threat to the global financial system has NOT receded. Paper currency is being debauched as never before – globally. Even the Swiss franc (partially backed by gold in the 70s) is a purely “fiat” currency, with no backing by hard assets! There IS no strong currency for traders to flee to if the US dollar weakens.This underlies recent statements by the Russians and Chinese calling for less reliance on US dollars as the global reserve currency. The Gulf oil states are planning to incorporate gold in their creation of a common currency. These cultures have revered gold for millennia – and the US dollar for just decades.By the way, if gold were to reach 4.5 times the S&P, the price of gold would spike to $4000! – and then probably retreat as quickly as it had risen. Gold stocks would probably rise a further multiple on the 4.5 times that the metal itself would rise.Unless you believe that Geithner’s TARF, TALF and “PeePIP” are going to work, AND that Congress will then approve a further $1 Trillion for bank re-capitalization, you might be wise to address the possibility of a “super-spike” in gold. The latest IMF report foresees a further $4 trillion in global financial losses before the carnage is over. Estimates are that US banks alone will require $1 trillion in new capital AFTER toxic assets are removed from their balance sheets! Only after such re-capitalization will bank balance sheets be strong enough to encourage bank managements to resume lending.Unless you believe the world’s key governments (US, UK, Germany, Japan, China, Russia) will get it right in the short term, and will cooperate to avoid beggaring-their-neighbors, you might consider the possibility of a further collapse in confidence in the banks and their paper money at some point during this crisis.Where does this leave us regarding how we think about gold, and how to trade it? Maybe the best stance is that technically gold and gold stocks are currently weakening on the weekly chart. How long this continues, how far it goes, who knows? Whether GLD and GDX stop their declines and reverse at the bottom of their trading channels, or break down further is unknowable. Perhaps Alex (concentrating on incremental changes) has it right.But, I can’t avoid looking at the possibility of the trade of a generation, if in fact gold shows behaviour similar to the comparable financial crises of the 20th century.Perhaps we need to identify what (technically) would be required to change the stance of gold bears (such as Grant) and or of gold bulls (such as Eric and myself). You may want to associate yourself with whichever position you favor, but we all need to maintain a trader’s mental flexibility and willingness to admit when the market shows him he’s wrong. Life will certainly be less stressful if I am proven wrong on the above notions!

The headline is that in Cycle 1 (ending in 1938) and cycle 3 (ending in 1979) gold rose to levels of 4.5 and 6 times the S&P (respectively). The first “super-spike” of the 30’s was a response to deflation – the great depression. The second “super-spike” in the 70’s a response to major inflation (including the OPEC oil embargoes). The common theme was a massive loss of faith in the banks and their paper money.I don’t need to remind anyone that today’s psychology is similar. Gold’s latest “mini-spike” to 1000 was at the collapse of Bear Stearns. In fact, the threat to the global financial system has NOT receded. Paper currency is being debauched as never before – globally. Even the Swiss franc (partially backed by gold in the 70s) is a purely “fiat” currency, with no backing by hard assets! There IS no strong currency for traders to flee to if the US dollar weakens.This underlies recent statements by the Russians and Chinese calling for less reliance on US dollars as the global reserve currency. The Gulf oil states are planning to incorporate gold in their creation of a common currency. These cultures have revered gold for millennia – and the US dollar for just decades.By the way, if gold were to reach 4.5 times the S&P, the price of gold would spike to $4000! – and then probably retreat as quickly as it had risen. Gold stocks would probably rise a further multiple on the 4.5 times that the metal itself would rise.Unless you believe that Geithner’s TARF, TALF and “PeePIP” are going to work, AND that Congress will then approve a further $1 Trillion for bank re-capitalization, you might be wise to address the possibility of a “super-spike” in gold. The latest IMF report foresees a further $4 trillion in global financial losses before the carnage is over. Estimates are that US banks alone will require $1 trillion in new capital AFTER toxic assets are removed from their balance sheets! Only after such re-capitalization will bank balance sheets be strong enough to encourage bank managements to resume lending.Unless you believe the world’s key governments (US, UK, Germany, Japan, China, Russia) will get it right in the short term, and will cooperate to avoid beggaring-their-neighbors, you might consider the possibility of a further collapse in confidence in the banks and their paper money at some point during this crisis.Where does this leave us regarding how we think about gold, and how to trade it? Maybe the best stance is that technically gold and gold stocks are currently weakening on the weekly chart. How long this continues, how far it goes, who knows? Whether GLD and GDX stop their declines and reverse at the bottom of their trading channels, or break down further is unknowable. Perhaps Alex (concentrating on incremental changes) has it right.But, I can’t avoid looking at the possibility of the trade of a generation, if in fact gold shows behaviour similar to the comparable financial crises of the 20th century.Perhaps we need to identify what (technically) would be required to change the stance of gold bears (such as Grant) and or of gold bulls (such as Eric and myself). You may want to associate yourself with whichever position you favor, but we all need to maintain a trader’s mental flexibility and willingness to admit when the market shows him he’s wrong. Life will certainly be less stressful if I am proven wrong on the above notions!Eric’s comment on my post about GLD’s daily and weekly charts made me pop up a monthly GLD. Here’s my favorite topping formation, a huge 1,2,3 Top formed on bearish divergence with the declining RSI and MACD indicators. If price drops, 65 is about right for a target. If my analysis is correct, then either inflation is not going to be a problem, or gold has finally lost it’s value as a monetary subsititute.I bet on the latter–these days, not a lot can be done with gold except wear it.

Eric’s comment on my post about GLD’s daily and weekly charts made me pop up a monthly GLD. Here’s my favorite topping formation, a huge 1,2,3 Top formed on bearish divergence with the declining RSI and MACD indicators. If price drops, 65 is about right for a target. If my analysis is correct, then either inflation is not going to be a problem, or gold has finally lost it’s value as a monetary subsititute.I bet on the latter–these days, not a lot can be done with gold except wear it.

As most of you know, I like volatility and it contractions and expansions.Here are two charts of GLD, the gold ETF. On both the weekly and daily charts, a large symmetrical triangle has been forming for several months. There has been two distinct lower highs–not good, while there was a creation of a double bottom, which is now being challenged. The 84-85 area is support at the 200 DSMA. If price breaks the 200, we are transitioning from a bull to a bear market and the drop to 78 should be quick. The weekly shows a similar view. Watch carefully over the next few days to see what happens–I will be.

Steve is one of the top-performing SpikeTrade Members. Last month he won so many performance bonuses that his renewal was free – with a positive balance carried over into the present month. When this Member speaks, it makes sense to pay attention – Alex E.I learned three important lessons during the last recession & bear market.First, I held a long position through the deepest decline and even added to it because all indicators were screaming oversold. I remember the agony as I watched it stay oversold for what seemed like an eternity. The magnitude of the push down had enough inertia to take it to depths I never thought possible.The Second lesson I learned was during the bottoming period. People kept expecting corrections and pull backs. But here again, it was occurring during tax season, there was a lot of retirement contribution $ waiting to jump in, there was a mile long line of shorts waiting desperately to cover and last but not least, there was the Plunge Protection team busy manipulating. Lower prices seemed to be rejected when the sentiment indicators were saying they should fall lower. So for what it’s worth, there is a lot of power behind this move not to mention manipulation once again by many of the same people who were present during the last go around.The third lesson was with regards to how to jump on this train in this volatile start-stop market. It seems like those who bought pull backs to value were often worse performers and often continued to drop on low volume from a lack of buyers. On the other hand, those who bought breakouts above resistance seemed to attract the greatest buy volume from the explosive squeeze conditions. In addition, it was extremely hard to get filled at value and the markets waved goodbye as they briskly stair stepped up.So perhaps “The Greater Fool Theory” should be redefined for this particular season in that the greater fool is one who buys below resistance vs above. I believe that – though it is contrary to value trading – it is the most consistent way to perform better in this stage of the market. I also think that this is the very reason why the sloppy amateurs do so well in this kind of market – due to their inclination to chase a stock that is breaking out and running from a short squeeze. It could also be the reason why the pros get chopped to death despite their A+ entries.IMO, those looking for another washout could be disappointed from the shorts who need to cover and the sideline IRA $ that needs in. The Consequence?… Lower price rejection.