Jock G is a SpikeTrade guest. He is a Camp graduate and an extremely serious researcher and trader – Alex

Another perspective on gold: First, there’s no doubt that GLD and GDX are looking technically weak right now. Here’s a chart noting 4 false breakouts of GDX at resistance of 38:

Since start of ’08, GLD has 3 times failed to close and hold above 97:

Since start of ’08, GLD has 3 times failed to close and hold above 97:

Longer-term charts are open to opposing interpretations:Grant looks at the monthly chart, sees a 1-2-3 top, and expects further weakness, Eric Fremd also looks at the monthly chart, but sees an inverted H&S, and potential for a long-term rally.

Longer-term charts are open to opposing interpretations:Grant looks at the monthly chart, sees a 1-2-3 top, and expects further weakness, Eric Fremd also looks at the monthly chart, but sees an inverted H&S, and potential for a long-term rally.This is no contradiction really, since no one can know the direction of the future “squiggles” of a chart. We can only assess future probabilities based on how we interpret today’s chart. And, events could change the picture tomorrow: oil blockade, assassination in Pakistan, Chinese pullback from buying US treasuries, inability of C and BAC to raise capital.

Short-term, a continued pullback looks likely. There’d be no chance of a major “spike” till GLD broke out and held (on volume) over 100, and GDX did so over 38. Should that happen, however, it’s probably off to the races. I feel certain this global financial crisis is going to go on for some time yet. Plenty of time for GDX and GLD to touch the bottom of their trading ranges, and then “spike” way above the top of their channels.

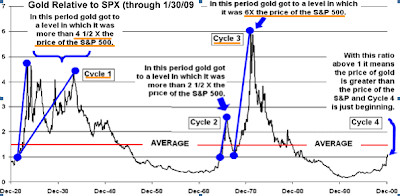

A look at the much longer term suggests why this could be the case. To me it’s compelling that in the major financial crises of the 30’s and 70’s, “super-spikes” DID occur. Here’s a look at a longer-term (and quite cluttered) chart:

The headline is that in Cycle 1 (ending in 1938) and cycle 3 (ending in 1979) gold rose to levels of 4.5 and 6 times the S&P (respectively). The first “super-spike” of the 30’s was a response to deflation – the great depression. The second “super-spike” in the 70’s a response to major inflation (including the OPEC oil embargoes). The common theme was a massive loss of faith in the banks and their paper money.I don’t need to remind anyone that today’s psychology is similar. Gold’s latest “mini-spike” to 1000 was at the collapse of Bear Stearns. In fact, the threat to the global financial system has NOT receded. Paper currency is being debauched as never before – globally. Even the Swiss franc (partially backed by gold in the 70s) is a purely “fiat” currency, with no backing by hard assets! There IS no strong currency for traders to flee to if the US dollar weakens.

The headline is that in Cycle 1 (ending in 1938) and cycle 3 (ending in 1979) gold rose to levels of 4.5 and 6 times the S&P (respectively). The first “super-spike” of the 30’s was a response to deflation – the great depression. The second “super-spike” in the 70’s a response to major inflation (including the OPEC oil embargoes). The common theme was a massive loss of faith in the banks and their paper money.I don’t need to remind anyone that today’s psychology is similar. Gold’s latest “mini-spike” to 1000 was at the collapse of Bear Stearns. In fact, the threat to the global financial system has NOT receded. Paper currency is being debauched as never before – globally. Even the Swiss franc (partially backed by gold in the 70s) is a purely “fiat” currency, with no backing by hard assets! There IS no strong currency for traders to flee to if the US dollar weakens.This underlies recent statements by the Russians and Chinese calling for less reliance on US dollars as the global reserve currency. The Gulf oil states are planning to incorporate gold in their creation of a common currency. These cultures have revered gold for millennia – and the US dollar for just decades.

By the way, if gold were to reach 4.5 times the S&P, the price of gold would spike to $4000! – and then probably retreat as quickly as it had risen. Gold stocks would probably rise a further multiple on the 4.5 times that the metal itself would rise.

Unless you believe that Geithner’s TARF, TALF and “PeePIP” are going to work, AND that Congress will then approve a further $1 Trillion for bank re-capitalization, you might be wise to address the possibility of a “super-spike” in gold. The latest IMF report foresees a further $4 trillion in global financial losses before the carnage is over. Estimates are that US banks alone will require $1 trillion in new capital AFTER toxic assets are removed from their balance sheets! Only after such re-capitalization will bank balance sheets be strong enough to encourage bank managements to resume lending.

Unless you believe the world’s key governments (US, UK, Germany, Japan, China, Russia) will get it right in the short term, and will cooperate to avoid beggaring-their-neighbors, you might consider the possibility of a further collapse in confidence in the banks and their paper money at some point during this crisis.

Where does this leave us regarding how we think about gold, and how to trade it? Maybe the best stance is that technically gold and gold stocks are currently weakening on the weekly chart. How long this continues, how far it goes, who knows? Whether GLD and GDX stop their declines and reverse at the bottom of their trading channels, or break down further is unknowable. Perhaps Alex (concentrating on incremental changes) has it right.

But, I can’t avoid looking at the possibility of the trade of a generation, if in fact gold shows behaviour similar to the comparable financial crises of the 20th century.

Perhaps we need to identify what (technically) would be required to change the stance of gold bears (such as Grant) and or of gold bulls (such as Eric and myself). You may want to associate yourself with whichever position you favor, but we all need to maintain a trader’s mental flexibility and willingness to admit when the market shows him he’s wrong. Life will certainly be less stressful if I am proven wrong on the above notions!