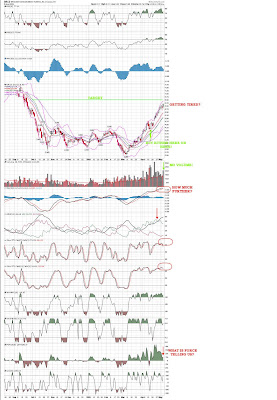

I saw the bearish divergence on the daily S&P 500 graph (screenshot attached).This says to me we are going to test the March bottom.Or may be I read the indicators in the wrong way?I will be happy to hear the opinion of other traders.Sorry for my English, it’s not my native language :)Thanks in advance– Vadim J

To tell you the honest truth I have been waiting for this trade opportunity to set up for several weeks. When it finally gapped down after I posted about the set up…I was shaking with a combination of excitement and fear! Sort of like dating the hottest girl in school with your inner insecurities kicking in that gives you the feeling she is out of your league. You finally go out on that date and you stumble and bumble and maybe make a move too early before she is ready. Well I jumped in on the gap down day…normally I tell myself to sit on my hands…a man who falls off a cliff is not going to bounce and start running the same day- in most cases! Unless he is some kind of Navy Seal.I had written out a sort of “target” or “plan” at or near $1…I took (in 20/20 hindsight) a not great entry @ $1.11. I had my mental stop in place! Trust me! Like I have said before: “I am not a very good trader” and I need your help and feedback to try to improve. That is why I am posting up these trades to try to stimulate discussion which acts as “therapy” for a trader and helps put in place better habits and reactions. Anyway the area I need to most improvement is selling! Selling is the hardest decision for me for some reason. I got some therapy today because I sold! I don’t know why but the entry although mostly always fuzzy is more clear than the exit- maybe because of fear, greed, regret…I really need to stomp out those worthless emotions.Today I hit the sell button at $1.61. Booking a 45% gain and $5000 profit. My target was profit driven along with some function of chart technical’s. I always think it can go a little higher and most likely it will…but it is hitting a potential resistance zone at the edge of the gap. If it pulls back it could set up another classical bullish pattern and offer a reentry point. And then there is the feedback- Thank you all to those that provided comments on the set up idea. I hope we can share more dialog and ideas in the future together. I am more of a technical trader than a fundamentalist. I like to be on the contrarian side most of the time, but not all of the time. Who knows about this one? I just thought it looked very attractive technically! Sort of like the hot Thai Girl looking like she has all the right features, except you never know if you will get a “surprise” when the action starts.As I look down at my level 1 GM is ticking higher now 1.74…but I am happy. A target was reached and a profit was booked! Now let’s go find another good trade!Good Trading,Eric F

This is a major speculative idea. I have been waiting for several weeks watching and waiting and today it began to form. Are we seeing what I think we are seeing? A major bullish divergence? Let’s watch and see. Price points of interest maybe cracking 1.27?I hope it goes to a $1…Am I too early? It looks like it may have a little more room to run on the downside but I am not sure of how much it can run…Although one thing I know- It will either GO TO ZERO or snap back to life…Thanks,Eric F

This is a major speculative idea. I have been waiting for several weeks watching and waiting and today it began to form. Are we seeing what I think we are seeing? A major bullish divergence? Let’s watch and see. Price points of interest maybe cracking 1.27?I hope it goes to a $1…Am I too early? It looks like it may have a little more room to run on the downside but I am not sure of how much it can run…Although one thing I know- It will either GO TO ZERO or snap back to life…Thanks,Eric F

Just wanted to revisit the BRCD trade idea I suggested back on 4/15-16 here on this blog: http://spiketradeblog.blogspot.com/2009/04/brcd-bull-or-bear-y-eric-f.html

Just wanted to revisit the BRCD trade idea I suggested back on 4/15-16 here on this blog: http://spiketradeblog.blogspot.com/2009/04/brcd-bull-or-bear-y-eric-f.htmlNow the exit is so much more difficult than the entry in my opinion! Today I was 30 cents from Target #2 and it was dark cloud cover on large volume. It looks like it is going sideways here at $6 and its stretched from the EMA’s.

Jock G is a SpikeTrade guest. He is a Camp graduate and an extremely serious researcher and trader – AlexAnother perspective on gold: First, there’s no doubt that GLD and GDX are looking technically weak right now. Here’s a chart noting 4 false breakouts of GDX at resistance of 38: Since start of ’08, GLD has 3 times failed to close and hold above 97:

Since start of ’08, GLD has 3 times failed to close and hold above 97:

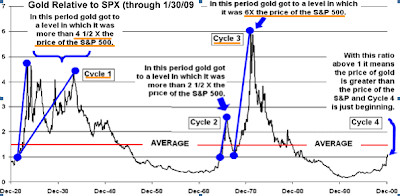

Longer-term charts are open to opposing interpretations:Grant looks at the monthly chart, sees a 1-2-3 top, and expects further weakness, Eric Fremd also looks at the monthly chart, but sees an inverted H&S, and potential for a long-term rally.This is no contradiction really, since no one can know the direction of the future “squiggles” of a chart. We can only assess future probabilities based on how we interpret today’s chart. And, events could change the picture tomorrow: oil blockade, assassination in Pakistan, Chinese pullback from buying US treasuries, inability of C and BAC to raise capital.Short-term, a continued pullback looks likely. There’d be no chance of a major “spike” till GLD broke out and held (on volume) over 100, and GDX did so over 38. Should that happen, however, it’s probably off to the races. I feel certain this global financial crisis is going to go on for some time yet. Plenty of time for GDX and GLD to touch the bottom of their trading ranges, and then “spike” way above the top of their channels.A look at the much longer term suggests why this could be the case. To me it’s compelling that in the major financial crises of the 30’s and 70’s, “super-spikes” DID occur. Here’s a look at a longer-term (and quite cluttered) chart:

Longer-term charts are open to opposing interpretations:Grant looks at the monthly chart, sees a 1-2-3 top, and expects further weakness, Eric Fremd also looks at the monthly chart, but sees an inverted H&S, and potential for a long-term rally.This is no contradiction really, since no one can know the direction of the future “squiggles” of a chart. We can only assess future probabilities based on how we interpret today’s chart. And, events could change the picture tomorrow: oil blockade, assassination in Pakistan, Chinese pullback from buying US treasuries, inability of C and BAC to raise capital.Short-term, a continued pullback looks likely. There’d be no chance of a major “spike” till GLD broke out and held (on volume) over 100, and GDX did so over 38. Should that happen, however, it’s probably off to the races. I feel certain this global financial crisis is going to go on for some time yet. Plenty of time for GDX and GLD to touch the bottom of their trading ranges, and then “spike” way above the top of their channels.A look at the much longer term suggests why this could be the case. To me it’s compelling that in the major financial crises of the 30’s and 70’s, “super-spikes” DID occur. Here’s a look at a longer-term (and quite cluttered) chart:

The headline is that in Cycle 1 (ending in 1938) and cycle 3 (ending in 1979) gold rose to levels of 4.5 and 6 times the S&P (respectively). The first “super-spike” of the 30’s was a response to deflation – the great depression. The second “super-spike” in the 70’s a response to major inflation (including the OPEC oil embargoes). The common theme was a massive loss of faith in the banks and their paper money.I don’t need to remind anyone that today’s psychology is similar. Gold’s latest “mini-spike” to 1000 was at the collapse of Bear Stearns. In fact, the threat to the global financial system has NOT receded. Paper currency is being debauched as never before – globally. Even the Swiss franc (partially backed by gold in the 70s) is a purely “fiat” currency, with no backing by hard assets! There IS no strong currency for traders to flee to if the US dollar weakens.This underlies recent statements by the Russians and Chinese calling for less reliance on US dollars as the global reserve currency. The Gulf oil states are planning to incorporate gold in their creation of a common currency. These cultures have revered gold for millennia – and the US dollar for just decades.By the way, if gold were to reach 4.5 times the S&P, the price of gold would spike to $4000! – and then probably retreat as quickly as it had risen. Gold stocks would probably rise a further multiple on the 4.5 times that the metal itself would rise.Unless you believe that Geithner’s TARF, TALF and “PeePIP” are going to work, AND that Congress will then approve a further $1 Trillion for bank re-capitalization, you might be wise to address the possibility of a “super-spike” in gold. The latest IMF report foresees a further $4 trillion in global financial losses before the carnage is over. Estimates are that US banks alone will require $1 trillion in new capital AFTER toxic assets are removed from their balance sheets! Only after such re-capitalization will bank balance sheets be strong enough to encourage bank managements to resume lending.Unless you believe the world’s key governments (US, UK, Germany, Japan, China, Russia) will get it right in the short term, and will cooperate to avoid beggaring-their-neighbors, you might consider the possibility of a further collapse in confidence in the banks and their paper money at some point during this crisis.Where does this leave us regarding how we think about gold, and how to trade it? Maybe the best stance is that technically gold and gold stocks are currently weakening on the weekly chart. How long this continues, how far it goes, who knows? Whether GLD and GDX stop their declines and reverse at the bottom of their trading channels, or break down further is unknowable. Perhaps Alex (concentrating on incremental changes) has it right.But, I can’t avoid looking at the possibility of the trade of a generation, if in fact gold shows behaviour similar to the comparable financial crises of the 20th century.Perhaps we need to identify what (technically) would be required to change the stance of gold bears (such as Grant) and or of gold bulls (such as Eric and myself). You may want to associate yourself with whichever position you favor, but we all need to maintain a trader’s mental flexibility and willingness to admit when the market shows him he’s wrong. Life will certainly be less stressful if I am proven wrong on the above notions!

The headline is that in Cycle 1 (ending in 1938) and cycle 3 (ending in 1979) gold rose to levels of 4.5 and 6 times the S&P (respectively). The first “super-spike” of the 30’s was a response to deflation – the great depression. The second “super-spike” in the 70’s a response to major inflation (including the OPEC oil embargoes). The common theme was a massive loss of faith in the banks and their paper money.I don’t need to remind anyone that today’s psychology is similar. Gold’s latest “mini-spike” to 1000 was at the collapse of Bear Stearns. In fact, the threat to the global financial system has NOT receded. Paper currency is being debauched as never before – globally. Even the Swiss franc (partially backed by gold in the 70s) is a purely “fiat” currency, with no backing by hard assets! There IS no strong currency for traders to flee to if the US dollar weakens.This underlies recent statements by the Russians and Chinese calling for less reliance on US dollars as the global reserve currency. The Gulf oil states are planning to incorporate gold in their creation of a common currency. These cultures have revered gold for millennia – and the US dollar for just decades.By the way, if gold were to reach 4.5 times the S&P, the price of gold would spike to $4000! – and then probably retreat as quickly as it had risen. Gold stocks would probably rise a further multiple on the 4.5 times that the metal itself would rise.Unless you believe that Geithner’s TARF, TALF and “PeePIP” are going to work, AND that Congress will then approve a further $1 Trillion for bank re-capitalization, you might be wise to address the possibility of a “super-spike” in gold. The latest IMF report foresees a further $4 trillion in global financial losses before the carnage is over. Estimates are that US banks alone will require $1 trillion in new capital AFTER toxic assets are removed from their balance sheets! Only after such re-capitalization will bank balance sheets be strong enough to encourage bank managements to resume lending.Unless you believe the world’s key governments (US, UK, Germany, Japan, China, Russia) will get it right in the short term, and will cooperate to avoid beggaring-their-neighbors, you might consider the possibility of a further collapse in confidence in the banks and their paper money at some point during this crisis.Where does this leave us regarding how we think about gold, and how to trade it? Maybe the best stance is that technically gold and gold stocks are currently weakening on the weekly chart. How long this continues, how far it goes, who knows? Whether GLD and GDX stop their declines and reverse at the bottom of their trading channels, or break down further is unknowable. Perhaps Alex (concentrating on incremental changes) has it right.But, I can’t avoid looking at the possibility of the trade of a generation, if in fact gold shows behaviour similar to the comparable financial crises of the 20th century.Perhaps we need to identify what (technically) would be required to change the stance of gold bears (such as Grant) and or of gold bulls (such as Eric and myself). You may want to associate yourself with whichever position you favor, but we all need to maintain a trader’s mental flexibility and willingness to admit when the market shows him he’s wrong. Life will certainly be less stressful if I am proven wrong on the above notions!

Is China a bellwether: How important are bearish signals of this country for the markets?My trading system is telling me that the long term trend is bullish (weekly one) but we have some short term bearish signs (daily ones). The couple USD/CAD confirms that as well as the industrial metals trend. However, China is one of the few indices of my system which shows a long term bearish signal. FXP, the inverse ETF of FXI, draws a perfect bullish MACD divergence and the Shanga

Is China a bellwether: How important are bearish signals of this country for the markets?My trading system is telling me that the long term trend is bullish (weekly one) but we have some short term bearish signs (daily ones). The couple USD/CAD confirms that as well as the industrial metals trend. However, China is one of the few indices of my system which shows a long term bearish signal. FXP, the inverse ETF of FXI, draws a perfect bullish MACD divergence and the Shanga

I wanted to post the BRCD chart since I think something interesting is going on…We have enjoyed an incredible rally for the last 5 weeks- among a long list of others. The question is – is this going to continue or will we see a major pull-back…Looking at the hard right edge it looks like another jumping on point, but I may be the greater fool…I post the weekly and daily chart below. Once it fills a gap at $5 it can go to $6.50 without much resistance…who knows before this bear market bounce is over it may just go to $8 where it either tests a gap in the daily chart or fills it… WEEKLY CHART- pulling back this week- does the trend have further to go or is it topping out? Price targets at 5 to 6.5…

WEEKLY CHART- pulling back this week- does the trend have further to go or is it topping out? Price targets at 5 to 6.5… DAILY CHART… Sorry for the large and busy chart- but this is what I got used to looking at…Overbought and pulling back…Oscillators are resetting but the big question is the trend?Disclaimer: I am long BRCD…

DAILY CHART… Sorry for the large and busy chart- but this is what I got used to looking at…Overbought and pulling back…Oscillators are resetting but the big question is the trend?Disclaimer: I am long BRCD…

Rodryk writes: I highly recommend looking at an article titled “The Aftermath of Financial Crises”.http://www.economics.harvard.edu/files/faculty/51_Aftermath.pdfOn p.5 there is a graph showing peak-to-trough equity price declines and years duration of downturn.Interestingly, the average peak-to-trough equity price decline in historic bear markets after severe financial crises was -55.9%, with the average downturn phase of the cycle lasting 3.4 years. Considering the S&P high of 1576.09 in Oct 2007 and the low of 666.79 in Mar 2009 we already have seen a -57.7% decline in just 17 months or 1.4 years, thus an duration significantly below average.Regards,Rodryk

I discovered the obvious last week – short-term support and resistance can be very useful in setting stops and entries. I also received a sharp, actually fatal, reminder that one must not forget tactical considerations while establishing or adjusting a trade, expecially in the heat of battle while the market is open. I chose a protective stop that was at a short-term support level, but I just didn’t think, and I placed it at a very vulnerable round number. Price dropped and touched my stop, didn’t go below it, then immediately took off to the upside. Two days later in my own account I used another short-term support level for a stop but placed it below the round number. Price dropped, touched the round support level price, didn’t go below it, and took off, and my position was safe. By way of background, I picked AVY as my Spike pick last week (March 23). AVY was a strong performer relative to the S&P500 the previous week. On the weekly, the trend was still down, but AVY had closed up the past two weeks and was near the lower envelope. MACD-H showed a bullish divergence back to the November low, having ticked up the previous two weeks; Lines were essentially flat since November, but the fast line was rising, the slow line shallowing. Force Index was generally following price. Price had not yet moved up past the November low and retested it.

By way of background, I picked AVY as my Spike pick last week (March 23). AVY was a strong performer relative to the S&P500 the previous week. On the weekly, the trend was still down, but AVY had closed up the past two weeks and was near the lower envelope. MACD-H showed a bullish divergence back to the November low, having ticked up the previous two weeks; Lines were essentially flat since November, but the fast line was rising, the slow line shallowing. Force Index was generally following price. Price had not yet moved up past the November low and retested it. On the daily, things did not appear as good over the short term. Trends of price and MACD Lines were up, but MACD-H had just ticked down from its highest level since mid-December. Force Index had dropped sharply the previous two days.On Monday March 23 the market opened higher and kept going, and my limit order wasn’t filled. On Tuesday March 24 price moved sideways and down. On Wednesday March 25 I placed another buy limit order and got left behind again as price streaked up from the open. At this point I was feeling kind of helpless, and that I had to figure out a way to jump onto the powerful moves reasonably safely. I decided to try OCO bracket orders: buy limit and buy stop, each with its own protective stop.In the course of trying to figure out how to enter these choppy conditions late Wednesday morning, I was surprised in my inexperience to find a couple of solid support and resistance lines on a 25-min chart that had developed over the period since the Monday open. These were located at 22.20, 22.50, and 23.00.

On the daily, things did not appear as good over the short term. Trends of price and MACD Lines were up, but MACD-H had just ticked down from its highest level since mid-December. Force Index had dropped sharply the previous two days.On Monday March 23 the market opened higher and kept going, and my limit order wasn’t filled. On Tuesday March 24 price moved sideways and down. On Wednesday March 25 I placed another buy limit order and got left behind again as price streaked up from the open. At this point I was feeling kind of helpless, and that I had to figure out a way to jump onto the powerful moves reasonably safely. I decided to try OCO bracket orders: buy limit and buy stop, each with its own protective stop.In the course of trying to figure out how to enter these choppy conditions late Wednesday morning, I was surprised in my inexperience to find a couple of solid support and resistance lines on a 25-min chart that had developed over the period since the Monday open. These were located at 22.20, 22.50, and 23.00. Based on these support/resistance levels, and because I had not proven to be very effective in guessing the market’s next direction, I placed OCO orders (buy limit/buy stop) in my own account for AVY, as noted on the above chart. After dropping to within a nickel of the limit entry price (22.60, just above 22.50 support), price rapidly increased to a point half way to the buy stop entry price (23.00) and dropped again until the order was filled at 22.60. Eight minutes later price dropped to my nice round stop at 22.10 support, touched 22.10 exactly, and took off again. It was a bonehead rookie mistake. I used an even, vulnerable stop (22.10) and got picked off. I noticed shortly after that that 22.10 happened to be the mid-day (intraday) low on Monday March 23.On Thursday March 26 I entered aother OCO order. This time the buy stop (23.00) was hit and the order filled at 23.28, granted with 28 ticks slippage. But I was in! AVY closed this day near 24. Before the open on Friday March 27 I raised my stop from 22.43 (a little below the 22.50 line) to 22.96 (just below the 23.00 line).On Friday March 27 AVY moved sideways-to-down all day. Price drifted downward to the 23.00 support level, touched it exactly, and drifted back upward. My stop at 22.96, just a few ticks below the 23.00 resistance/support line, saved me, just like in the textbooks!I must admit that I was surprised at how faithfully the price movements “honored” these rather arbitrary horizontal lines. Last week’s experience told me that it is essential that I look further into short-term support and resistance, and I will continue to attempt to use the concept in making short-term decisions in these unpredicable markets.

Based on these support/resistance levels, and because I had not proven to be very effective in guessing the market’s next direction, I placed OCO orders (buy limit/buy stop) in my own account for AVY, as noted on the above chart. After dropping to within a nickel of the limit entry price (22.60, just above 22.50 support), price rapidly increased to a point half way to the buy stop entry price (23.00) and dropped again until the order was filled at 22.60. Eight minutes later price dropped to my nice round stop at 22.10 support, touched 22.10 exactly, and took off again. It was a bonehead rookie mistake. I used an even, vulnerable stop (22.10) and got picked off. I noticed shortly after that that 22.10 happened to be the mid-day (intraday) low on Monday March 23.On Thursday March 26 I entered aother OCO order. This time the buy stop (23.00) was hit and the order filled at 23.28, granted with 28 ticks slippage. But I was in! AVY closed this day near 24. Before the open on Friday March 27 I raised my stop from 22.43 (a little below the 22.50 line) to 22.96 (just below the 23.00 line).On Friday March 27 AVY moved sideways-to-down all day. Price drifted downward to the 23.00 support level, touched it exactly, and drifted back upward. My stop at 22.96, just a few ticks below the 23.00 resistance/support line, saved me, just like in the textbooks!I must admit that I was surprised at how faithfully the price movements “honored” these rather arbitrary horizontal lines. Last week’s experience told me that it is essential that I look further into short-term support and resistance, and I will continue to attempt to use the concept in making short-term decisions in these unpredicable markets.